Lots of points enthusiasts keep the sapphire reserve in their wallet because of the terrific perks.

Downgrade chase sapphire preferred after getting reserve.

So i opened the chase sapphire reserve.

For example sometimes readers have the chase sapphire preferred card and want to downgrade it to the chase freedom unlimited and then apply for the chase sapphire reserve card the order of this is important since you can t be approved for the reserve if you currently have the preferred or have received a new cardmember bonus on it.

Photo by riley arthur for the points guy this is probably the most common plan i ve seen for getting rid of the chase sapphire reserve.

By valencia patrice higuera updated.

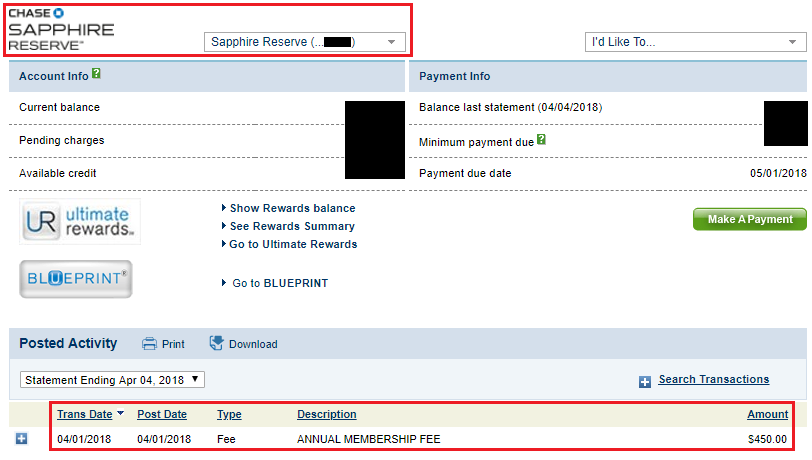

The sapphire reserve annual fee is 450 per year.

It makes sense because the preferred offers a similar card structure with a much.

The chase sapphire reserve earns 3 ultimate rewards points per dollar spent on travel and dining compared to the sapphire preferred s rewards rate of 2 points per dollar in the same categories.

While the sapphire preferred annual fee is 95 per year and is waived the first year you have the card.

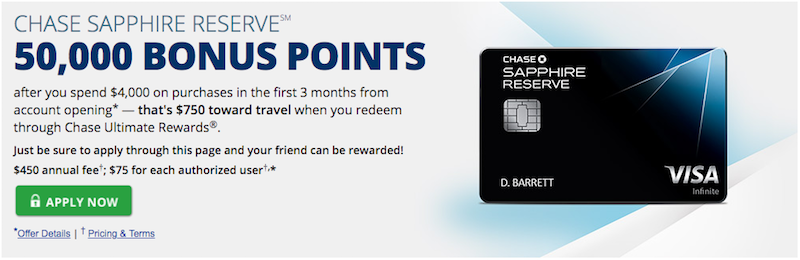

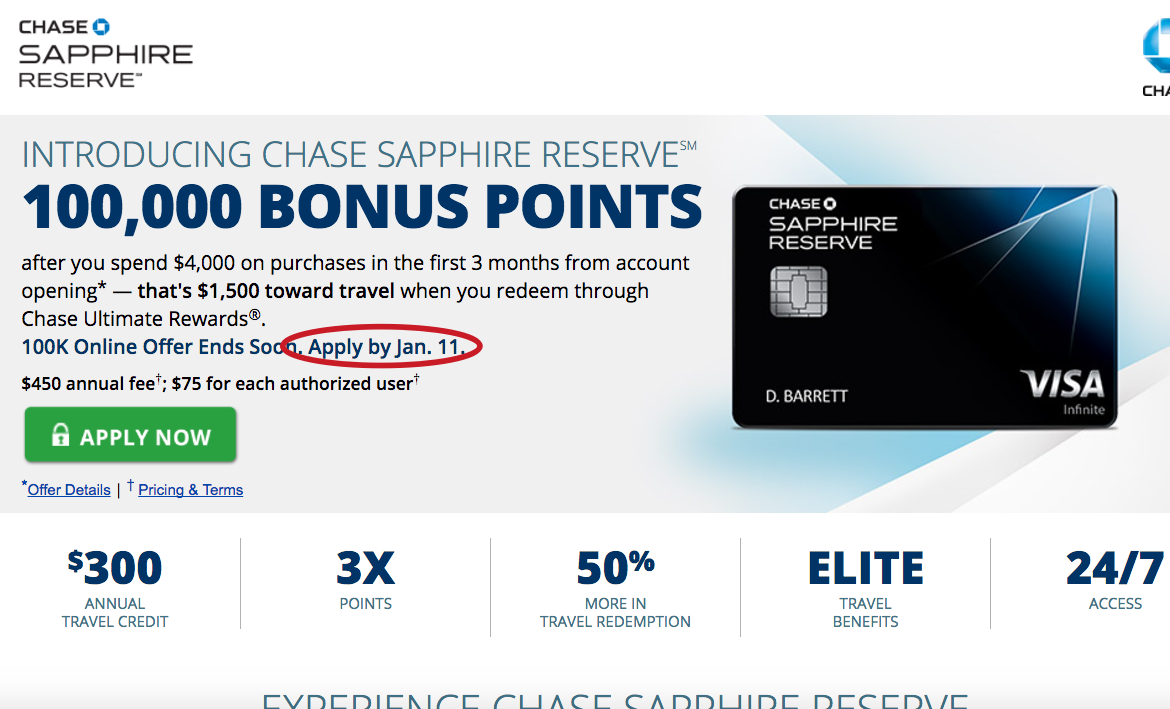

That s 1 000 toward travel when you redeem through chase ultimate rewards.

That s because you re now only allowed one sapphire branded card at a time.

If you now want to apply for the chase sapphire preferred card for its 80 000 point bonus after you spend 4 000 on purchases in the first 3 months after account opening you must first downgrade the sapphire reserve.

Chase sapphire preferred card.

The chase freedom earns 5x the points on rotating quarterly categories such as groceries gas and dining while the chase freedom unlimited earns 1 5x on all purchases.

Then instead of closing the chase sapphire preferred card i downgraded to the chase freedom unlimited which charges a 0 annual fee allowing me to keep the original account open so i could continue lengthening my credit history positively impacting my credit health.

Find out how chase sapphire preferred credit card customers can upgrade to the chase sapphire reserve card which has a much higher annual fee but better perks.

Earn 80 000 bonus points after you spend 4 000 on purchases in the first 3 months from account opening.

That is no longer the case.

To get the extra perks with the sapphire reserve you ll pay a higher annual fee.

A big argument for getting the chase sapphire reserve used to be that it was just a 55 difference between it and the chase sapphire preferred after the 300 travel credit.